The smart Trick of Lighthouse Wealth Management, A Division Of Ia Private Wealth That Nobody is Talking About

Wiki Article

Not known Details About Lighthouse Wealth Management, A Division Of Ia Private Wealth

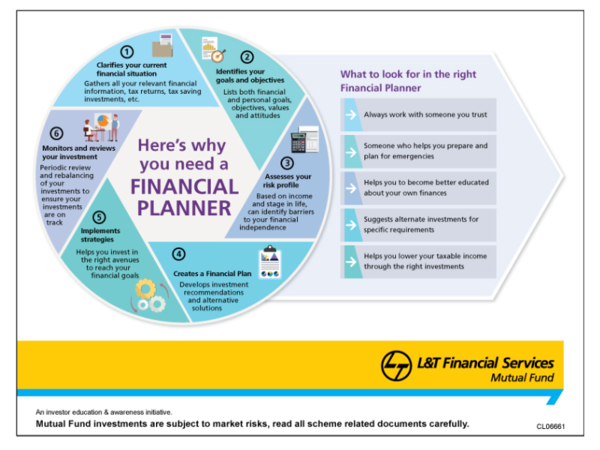

So, we urge you to take this very first step learn more about the advantages of working with a monetary expert and see what a distinction it makes to have a partner on your financial trip. A monetary consultant can bring you closer to the future you see on your own in several means from producing personalized savings techniques for all your short- and long-lasting goals, to choosing the best investment products for you, overcoming estate considerations and setting up insurance policy defense for you and your loved ones.

Many wonder what an economic consultant does. As a whole, these specialists aid you make decisions about what you ought to make with your cash, which might consist of financial investments or other strategies. A financial expert is commonly in charge of greater than just performing trades in the market in support of their customers.

To achieve your objectives, you may require a experienced specialist with the best licenses to help make these strategies a truth; this is where an economic advisor is available in. With each other, you and your expert will cover many subjects, including the amount of money you should conserve, the kinds of accounts you require, the kinds of insurance policy you should have (consisting of lasting treatment, term life, handicap, and so on), and estate and tax preparation.

Listed below, find a listing of the most typical solutions offered by financial advisors.: A financial expert uses guidance on investments that fit your design, objectives, and risk tolerance, creating and adapting investing technique as needed.: An economic consultant creates techniques to assist you pay your financial obligation and prevent debt in the future.: An economic expert offers suggestions and approaches to develop spending plans that aid you meet your goals in the short and the long term.: Component of a budgeting technique might consist of methods that aid you pay for greater education.: Likewise, a financial expert creates a saving plan crafted to your particular needs as you head into retirement.: An economic consultant assists you recognize individuals or organizations you desire to receive your heritage after you pass away and develops a strategy to execute your wishes.: An economic expert provides you with the ideal lasting remedies and insurance options that fit your budget.: When it concerns taxes, a financial advisor may help you prepare tax returns, make the most of tax deductions so you get the most out of the system, schedule tax-loss collecting protection sales, make sure the very best use of the capital gains tax obligation prices, or plan to reduce taxes in retired life.

The Single Strategy To Use For Lighthouse Wealth Management, A Division Of Ia Private Wealth

It is very important for you, as the consumer, to comprehend what your planner advises and why. You must not follow an expert's suggestions unquestioningly; it's your money, and you must comprehend just how it's being deployed. Keep a close eye on the charges you are payingboth to your consultant and for any kind of funds purchased for you.

The ordinary base salary of a monetary advisor, according to. The decision to get professional assistance with your cash is a highly personal one, however any time you're really feeling overwhelmed, puzzled, emphasized out, or scared by your monetary situation may be an excellent time to look for a financial expert. retirement planning canada.

It's additionally great to come close to a financial advisor when you're feeling monetarily protected but you want someone to make certain that you get on the appropriate track. An advisor can suggest feasible enhancements to your strategy that may assist you achieve your objectives better. https://www.gaiaonline.com/profiles/lighthousewm/46474113/. Finally, if you do not have the moment or passion to handle your financial resources, that's one more great reason to work with a monetary advisor.

Below are some even more specific ones. Because we reside in a world of inflation, any kind of money you maintain in money or in a low-interest account decreases in worth each year. Spending is the only means to make your money expand, and unless you have an extremely high earnings, investing is the only way lots of people will certainly ever before have enough money to retire.

Lighthouse Wealth Management, A Division Of Ia Private Wealth Things To Know Before You Get This

Generally, spending should boost your internet worth significantly. If it's refraining that, hiring an economic advisor can help you learn what you're check this doing wrong and right your program before it's as well late (https://lighthousewm.carrd.co/). A monetary expert can also help you assembled an estate plan to make certain your assets are dealt with according to your dreams after you pass away

A fee-only financial advisor might be able to use a less biased opinion than an insurance policy agent can. Talk to a couple of different advisors and contrast their solutions, design, and fees.

You want a consultant that is aware of your threat resistance and urges you to take sensible choices. A rule proposed by the Division of Labor (DOL) would certainly have called for all economic specialists who deal with retirement plans or give retirement plan advice to offer guidance that is in the client's benefit (the fiduciary criterion), in contrast to merely ideal for the customer (the suitability standard).

Yet in the approximately three-year period in between Head of state Obama's proposal of the regulation and its ultimate death, the media dropped more light than it had previously on the different methods financial experts work, just how they charge for their solutions and how the viability standard may be less practical to customers than the fiduciary requirement - retirement planning canada.

The Of Lighthouse Wealth Management, A Division Of Ia Private Wealth

Others, such as certified economic coordinators(CFPs), already stuck to this criterion. Under the suitability criterion, monetary advisors typically work on commission for the products they market to clients.

Report this wiki page